Precious metals have been mined for currency and jewellery for centuries. It’s only relatively recently that they have been put to use in new technologies. The average smartphone contains small amounts of gold, silver, palladium and platinum. Silver powers the solar panel industry and platinum in catalytic convertors filter vehicle exhaust gases.

But as precious metals are used to power new industrial technologies, digital technology in the form of digital currencies is eroding some of the demand for precious metal investment. What is the relationship between precious metals and technology now, and how will it change in the future?

Precious metals in industrial technology

It’s fair to say that the digital revolution might never have happened without precious metals, or at least it would have been delayed.

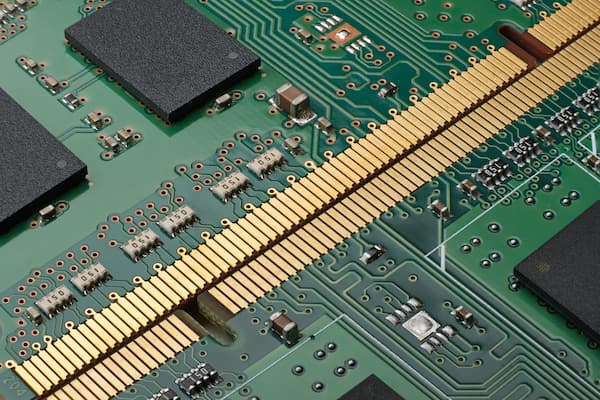

Gold’s main demand driver may be physical gold investment and jewellery, but around 8% of global gold demand went into technology in 2020, according to Statista. Gold can be found in many electronic devices as part of circuit boards, computer chips and connectors. It’s the perfect material for electronics as it’s highly conductive but doesn’t tarnish easily.

Platinum

Platinum, meanwhile, is also an invaluable industrial metal used in cars, computers and medical treatments. Its automotive applications account for the largest share of platinum production. It is essential for reducing harmful diesel emissions in vehicles around the world. Other industrial uses include as a chemical catalyst in glass products, including LCD screens, hard drives, laptops and pacemakers.

Palladium

Palladium is also used in catalytic converters. It helps to reduce emissions from petrol and hybrid cars and is also used in electronics and dentistry to a lesser degree.

Silver

Of all the precious metals, though, silver is the most diversely and widely used in an industrial setting. Industrial use accounts for well over half of silver demand (486 million ounces in 2020). Its antibacterial qualities are used in medical devices and procedures. Silver’s conductivity is essential for semiconductors, RFID sensors, batteries, LED chips, electrical switches and almost every device in production today.

Powering Solar

Silver’s use in solar panels has been pivotal in the growth of this sustainable energy source. Silver’s conductivity maximizes the conversion of solar energy into electricity. It is relatively low cost compared to other precious metals means it can be fabricated into the panels cost-effectively.

Physical Gold And Pensions

Discover the benefits of investing in physical gold through your SIPP with our handy guide.

Precious Metals and Technology

Today, technology and electronics are evolving rapidly. Even if some use cases for precious metals disappear, different applications in technology are being developed all the time, and industrial demand for metals like gold, silver and platinum will always play some part in driving their value.

Is precious metal being usurped by technology?

While technology has given precious metals a foothold in new devices and industrial applications, a by-product of this technology is muscling in on the investment value of precious metals – digital currencies.Physical gold or other precious metals are a tangible store of value. Alternative currencies like Bitcoin or Ethereum, or digital tokens, which are a digital representation of value, are designed explicitly for existing only in the cyber realm. It has only been through new technologies, ironically underpinned by precious metals powering computers and displays worldwide, that cryptocurrencies have grown in value. Is their convenience undermining the value of physical metals, or can they co-exist inside and alongside digital technology?

Digital Currencies

Bitcoin, Ethereum and a host of other digital forms of payment are all cryptocurrencies. They exist entirely digitally and are not a fiat currency issued by a government like the Dollar, Sterling, Euro or Yen. The key differentiating factor between cryptocurrencies and fiat currencies is that the former does not rely on a central bank or single administrator overseeing the currency. Instead, it uses complex algorithms to create a decentralized digital ledger system that holds all the transactional information about the currency within it. This ‘democratization of currency was bitcoin’s central ethos when an anonymous person or group developed it in 2008.

Cryptocurrency Value

The value of cryptocurrencies has swung wildly since they came into use. Bitcoin is the most popular but has been subject to erratic surges and plunges in value over the years. Throughout the COVID-19 pandemic, it has been on the rise but interspersed with sudden dips and equally quick increases. At the start of 2021, a Bitcoin was worth around $40,000. It added another 50% over the course of several months and then lost all those gains in the space of about a week. The most recent price slump was in May 2020 (which similarly affected the value of other digital currencies). This was prompted by a crackdown on cryptocurrency mining and trading activities in China, the country with the most mining activity.

China Cracks Down on Crypto

The Chinese government concerns are bound up in increasing speculation (which propels the value to such highs and lows) and the use of unregulated digital currencies for black-market and illegal payments and trades. The technology that enabled unregulated currencies to develop and thrive is now under the most scrutiny by governments and regulators. It has also created an environmental threat because cryptocurrencies need so much computing power.

149 Terrawatts of Power and Growing

Bitcoins are created through a process called mining. This involves an army of high-powered computers (nodes) working on a complex maths problem. The volume of computing power now required is so vast its combined electricity usage is greater than the entire country of Pakistan. Environmental advocates are calling into question the sustainability of cryptocurrencies. Energy consumption is becoming a genuine risk to the value of cryptocurrencies, alongside the hazards of a lack of regulation.

The Future of Investments

Digital investments are still in their infancy. Gold and silver have been mined for centuries, while bitcoin has been mined for just a decade. Both have their place in the armour of investments, satisfying risk-averse safe-haven investors (precious metals) and risk-taking speculators (digital currencies).

Precious metals have enabled the technology revolution and the growth of digital currencies. But their value has endured for thousands of years, and they won’t yet be usurped by the technology they helped to create.